Financial Services Institutions Bureau: Functions & Objectives

By BYJU'S Exam Prep

Updated on: September 25th, 2023

Financial Services Institutions Bureau(FSIB) has been established as an autonomous body under Govt. of India to recommend the appointment of directors for the Public Sector Banks and Insurance companies. As this has been in the news recently, you can expect GA questions from this topic in your upcoming Bank and Insurance exams 2022.

This article will go through the history, objectives, formation, and functions of the Financial Services Institutions Bureau(FSIB). Kindly read the complete article.

Table of content

What is Financial Services Institutions Bureau?

The Central Government has established the Financial Services Institutions Bureau with effect from July 1, 2022, with the goal of recommending candidates for appointment as full-time directors and non-executive chairpersons on the Boards of financial services institutions as well as providing guidance on a variety of other issues relating to personnel management in these institutions. The Secretary and four officials make up the Secretariat of the Bureau at the moment.

The headhunter for directors of state-owned banks and financial institutions, the Banks Board Bureau (BBB), has undergone certain changes and become Financial Services Institutions Bureau (FSIB).

The Department of Financial Services has been asked by the Appointments Committee of the Cabinet (ACC) to modify the Nationalized Banks (Management and Miscellaneous Provisions) Scheme of 1970/1980 as necessary with the approval of the Finance Minister, and then to notify the government resolution for creating FSIB as a single entity.

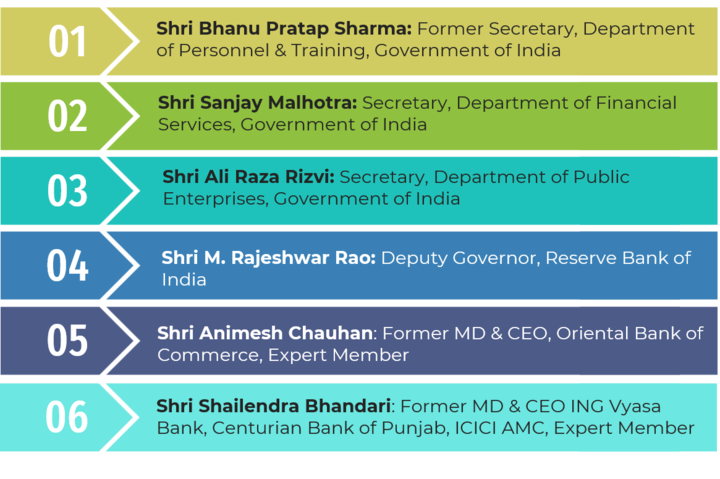

FSIB members

- The FSIB will comprise

- a chairperson nominated by the central government;

- The Chairman of IRDA

- One of the Deputy Governors of RBI.

- In addition to them, there will be three members who are knowledgeable about insurance and another three who are knowledgeable about banks and other financial institutions.

- In the future, the FSIB chairman and the three members handling affairs relating to banking and financial institutions will be selected by a search committee that will comprise the RBI governor.

Why It has Replaced Bank Board Bureau?

When a general manager at the state-owned National Insurance Company challenged the appointment of a person under him for the Director’s job at the BBB, the Delhi High Court deemed the BBB an incompetent authority. Following the directive, 10–11 BBB–appointed directors were required to resign from their positions.

To end this problem, Govt. of India has approved the establishment of the Financial Services Institutions Bureau subject to the approval of the Appointment Committee of the Cabinet.

What is Bank Board Bureau?

In order to significantly advance banking reform in general and the modernization of public sector banks in particular, the Banks Board Bureau was established in 2016 as a part of the Indhadhanush Plan. Since India marked its 50th anniversary of nationalizing its banks in 2019, the Banks Board Bureau subject has been in the news. This was established to develop and implement acceptable processes for board member appointments, extensions, and terminations in public sector banks, public sector insurance companies, and financial institutions.

The Reserve Bank of India’s Central Office in Mumbai serves as the headquarters of the Banks Board Bureau, which went into operation on April 1st, 2016. BBB was one of the seven points of the Indradhanush Mission’s modernization strategy for public sector banks.

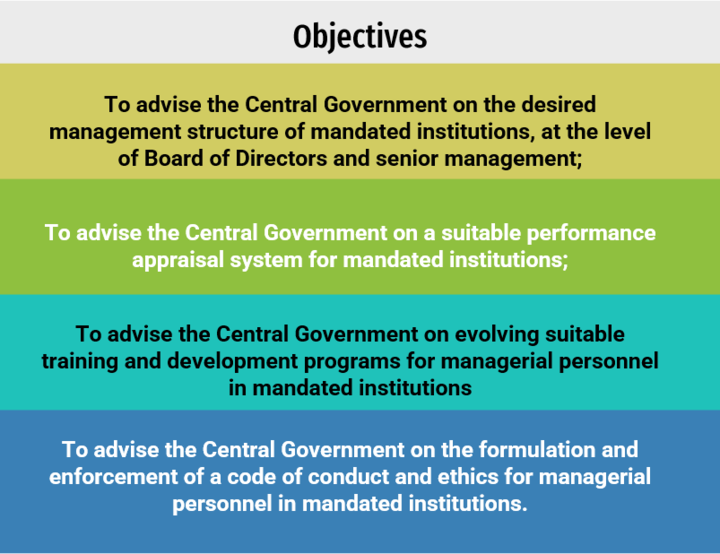

Mandates & Objectives:

The mandate of the Bureau includes

- To recommend the selection and appointment of a Board of Directors in Nationalised Banks, Financial Institutions, and Public Sector Insurance Companies (Whole Time Directors and Chairman);

- to provide advice to the Central Government on issues involving the appointment, confirmation of, or extension of the term of office, and termination of the services of Directors of institutions under the mandate.

How Important is the Role of FSIB?

- Public sector banks underwent consolidation when BBB was implemented, first with Bank of Baroda in 2018 and then with 10 PSU banks a year later. Another round of bank mergers and the privatization of banks and insurance firms is conceivable.

- The question of whether PSU organizations are prepared to resist the test of privatization from an operational and management standpoint frequently comes up, and this has a close connection to the productivity of human resources at all levels.

- As a result, the FSIB’s unspoken mandate would be to prepare banks and insurance firms for the privatization process and carry out the required cleanup/HR upliftment operations.

General Awareness questions can be asked on this topic in the following bank exams.

|

S. No |

Name of the Bank Exams |

|

1 |

|

|

2 |

|

|

3 |

|

|

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

|

|

9 |

|

|

10 |

|

|

11 |

|

|

12 |

|

|

13 |

|

|

14 |

If you are aiming to clear Bank Exams in 2022/2023, then join the Online Classroom Program where you will get: