Types of Risk in Banks – Know the concept in layman language

By BYJU'S Exam Prep

Updated on: September 25th, 2023

Risk is defined as the probability that actual results will differ from expected results. Bank faces many types of risk. We have come up with an article on ‘Types of Risks’ in Banking Sector. Read the full article and solve the quiz in the end of the article for checking your knowledge.

Table of content

The banking system now seems to be trapped in an unusual condition where the main concern is diverted from credit risk to operations risk. Risk in Banks arise due to the occurrence of some expected or unexpected events in the economy or the financial markets.

As we all know, banks deal in money, where risk is inherent which cannot be completely removed but can only be reduced. Before coming to various types of risks, we have briefly described about the concept of risk in understandable way. Lets dig deep inside:

Know the concept in layman language

What do you mean by Risk in banks?

A risk in the bank means “future uncertainty” of earning and outcome in case of failure. It can also arise from staff oversight or mala fide intention, which causes erosion in the values of assets thus leading to a reduction in the bank’s intrinsic value.

For example:

1. Fraud of Rs. 11,400 crores in the Punjab National Bank (PNB). The type of risk bank affected in this case is (a) Credit risk and (b) Operational risk (c) reputation loss.

2. Videocon Group gets Rs. 3250 crore loans from ICICI Bank but failed to repay Rs. 2810 crore. In 2017, ICICI classified this as an NPA and the current outstanding is Rs 2,810 crore. With the large amount involved the reputation of the bank is at stake. This is a clear example of reputation risk for Bank.

3. Rising NPA (Non-Performing Asset) of bank and failure to repay loan result (a) substantial credit loss (b) reputation loss and (c) operational risk too for Bank.

All the above three examples led to the loss of earnings and in long run failure of the banking system.

Types of Risk in Banks

Three major risks of banking in India

- Credit risk: Now a day’s banks are affected with huge non-performing assets, which leads to credit risk.

- Operational risk:

- Market risk: With the recent fraud in Punjab National Bank (PNB), it can be assumed that its blight will affect several other Indian banks. This is a clear example of operational risk faced by banks.

Understanding types of Risk with the concept

Credit Risk

- It is also known as default risk.

- It is the risk that arises when the borrower fails to pay the contractual interest or principal on its debt obligations.

- This type of risk is basically concerned with investors who hold bonds in their portfolios.

- Government bonds, especially those issued by the federal government, have the least amount of default risk.

- Corporate bonds have the highest amount of default risk, but also higher interest rates.

- Bonds with a lower chance of default are considered investment grade, while bonds with higher chances are considered high yield or junk bonds.

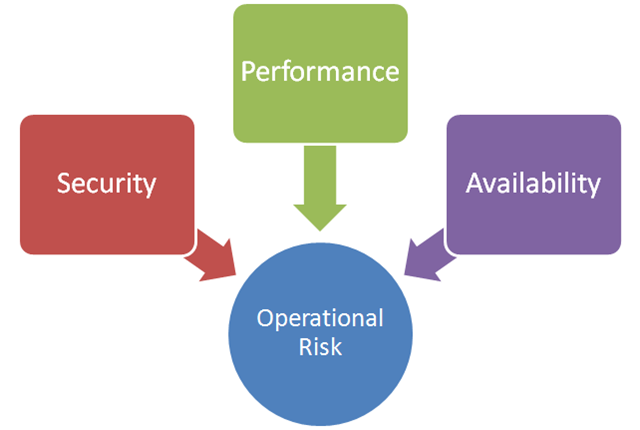

Operational Risk

- Basel Committee on Banking Supervision has defined operational risk as to the risk of loss resulting from inadequate or failed internal processes, people, and systems or external events.

- All banks face operational risks in their day to day operations across all their departments including treasury, credit, investment, information technology.

- There are three main causes of this risk:

- Human Intervention & Error

- Failure of the IT/internal software & systems.

- Failure of Internal Processes to transmit data & information accurately

Let us understand the concept:

Bank of India (BOI) is a Public-Sector Bank in India. BOI provides a wide range of services to its customers like:

- RTGS (Real-time gross settlement)

- NEFT (National Electronic Fund Transfer)

- Other online modes of fund transfer

- Account update through computer etc.

Sudden failure of the centralised computer system or Core Banking Solution (CBS) where each computer is connected to one central computer, which controls all working and failure of the central computer results in what?

- Substantial loss and halt of essential services offered to Customers like RTGS, NEFT, online account update etc. This type of risk called “Operational risk”.

Market Risk

Due to market movements, sometimes banks share goes down (assume SBI share down by 50 points, this is also a risk for SBI).

Let us understand the concept

Let us assume – IDFC is a private sector bank in India. The share price of IDFC on is 90 rupees per share and share price fall to 75 rupees per share due to –

- Bharat Bandh by SC/ST people

- Rising instability of PSBs let NIFTY bank share fall which leads an impact on IDFC share price also.

The sudden reduction in the price of the share which is associated with the investment of Banks in a market. Such risk is called “Market Risk”.

Other types of Risks

Systematic Risk

- It is risk that can affect an entire economic market overall or a large percentage of the total market. It is also known as market risk or as un-diversifiable risk.

- Losing investments due to factors like political risk and macroeconomic risk, that affects the performance of the overall market.

- It cannot be easily mitigated through portfolio diversification.

- Other common types of systematic risk are interest rate risk, inflation risk, currency risk, liquidity risk, country risk, and socio-political risk.

Let us understand the concept:

Strike in a Bank – If a bank strike caused by all the employees of the banks on the national level and the strike is extended for a longer duration then its impact would severely affect all the firms and individuals in a similar manner.

Unsystematic Risks

- Unsystematic risk is the risk that affects a very small number of assets.

- It is also known as the Nonsystematic Risk, Specific Risk, Diversifiable Risk, and Residual Risk.

Business Risk

- Business risk refers to the possibility of a commercial business that can make inadequate profits due to uncertainties.

- Business risk covers expenses of business operation and functioning like salaries, production costs, facility rent, office, and administrative expenses.

- Company’s business risk level is influenced by factors such as the cost of goods, profit margins, competition, and the overall level of demand.

Let us understand the concept

Let us assume – Bank of Baroda invested Rs. 50 lakhs in a start-up named ABC which works on food supply management.

The total duration of the loan is 10 years. But company ABC failed to generate adequate revenue and profit at the end of 10 years, result fails to repay amount and interest collected in 10 years to BOB.

This led to what? Risk called Business risk. Loss of amount invested i.e. 50 rupees lakh for BOB. R. 50 lakh is an asset for BOB.

Reputation Risk

When risk arising from negative public opinion due to big fraud or scam and inability of the bank to control operational risk.

- no repayment of loan

- large debt

- rising NPA

All such case creates a negative image of banks. (You can take above example of PNB & ICICI Bank). This negative image led to damage to the reputation of the bank. This type of risk called “reputation risk “

Definition: Credit loss + Business loss = reputation loss for Bank. This reputation loss is risk called reputation risk.

Liquidity Risk

- It is associated with an investor’s ability to transact their investment for cash.

- This usually occurs due to the inability to convert a security or hard asset to cash without a loss of capital and/or income in the process.

At last – As risk is directly proportionate to return, the more risk a bank takes, it can expect to make more money.

Foreign-Exchange Risk

- Foreign exchange risk (or exchange rate risk) applies to all financial instruments that are in a currency other than the domestic currency.

- It is the losses that an international financial transaction may incur due to currency fluctuations.

- Example: Transaction risk, Economic risk.

- Hedging is most commonly used process to mitigate this risk.

- Futures hedge, Forward hedge, Money market hedge, and Currency swaps hedge.

- Internal Hedging: Legging and Lagging

Attempt the Quiz based on the article

Click here to access Test Series

Why BYJU’S Exam Prep Test Series?

- Unlimited access to 18+ Bank and Insurance Exam mock tests

- Mock Tests designed by Exam Experts.

- Detailed Performance Analysis.

Download the BYJU’S Exam Prep App Now.

The most comprehensive exam prep app.

#DreamStriveSucceed