Highlights of Apps/ Products launched by various Banks

By BYJU'S Exam Prep

Updated on: September 25th, 2023

Dear Aspirants,

With every passing day, the level and importance of Current Affairs is growing in the Competitive Examination. We have come up with information regarding various Apps/ Products that have been launched by different banks. Go through the whole article to grasp the essence and score exceptionally well in the examination.

IndusDirect Mobile App

- This app has been launched by IndusInd Bank

- It is Corporate Mobile Banking Application

- Using this, Corporate customers can authorise payments via the Mobile App, view account balances and can use variou features like Payment Initiation, Authorization, enquiry,

- It is based on bio-metric Authentication

- It is available on Google Play Store as well as Apple Store

- Quick Statements (last 10 transactions) view, Account Statement view and Trade transaction dashboard are its other significant features.

Insta Flexicash

- It has been launched by ICICI Bank

- It is a digital facility for salary account customers overdraft (OD) approval.

- It can be availed using Bank’s internet banking platform

- It can be availed within 48 hours.

- Credit limit under this facility will be offered up to three times of net salary

- Flexibility of repayment without any foreclosure charges

- Auto sweep-in facility is provided in this.

e-Kisaan Dhan

- The app has been launched by HCFC for farmers

- It will act as a one-stop solution for facilitating banking and agricultural services to the farmers.

- The app has been launched under ”Har Gaon Hamara” initiative

- Value-added services like mandi prices, latest farming news, weather forecast, information on seed varieties, SMS advisory, e-pashuhaat, Kisan TV, etc will also be provided through this.

- Loans, Bank accounts, insurance facilities, Govt social security schemes can also be availed using the app.

Yuva Pay

- The payment system Yuva Pay has been launched by Yes Bank.

- This will enable contactless payments to its customers.

- It has been launched in collaboration with UDMA Technologies.

- It can be used for: Paying Utility bills like municipal, house, water tax, electricity; Making insurance renewals; FASTag recharges; EMI payments; and payments at retail outlets

- It will offer bill payments through the Bharat Bill Pay

- It also has Interactive Voice Response Services (IVRS) where all transactions are processed using OTP and T-PIN (telephone pin) authentication.

ZipDrive

- It an instant auto loan facility launched by HDFC

- It has exclusively available for HDFC Bank customers

- It can be availed with NetBanking anytime, anywhere

- Through this, Customers can opt for their choice of car model, dealer, loan amount within eligible limits and tenure online along with on-road 100% funding

- The loan amount will be disbursed instantly

- It can be availed 24/7 in Online mode.

- It has Negligible Paperwork.

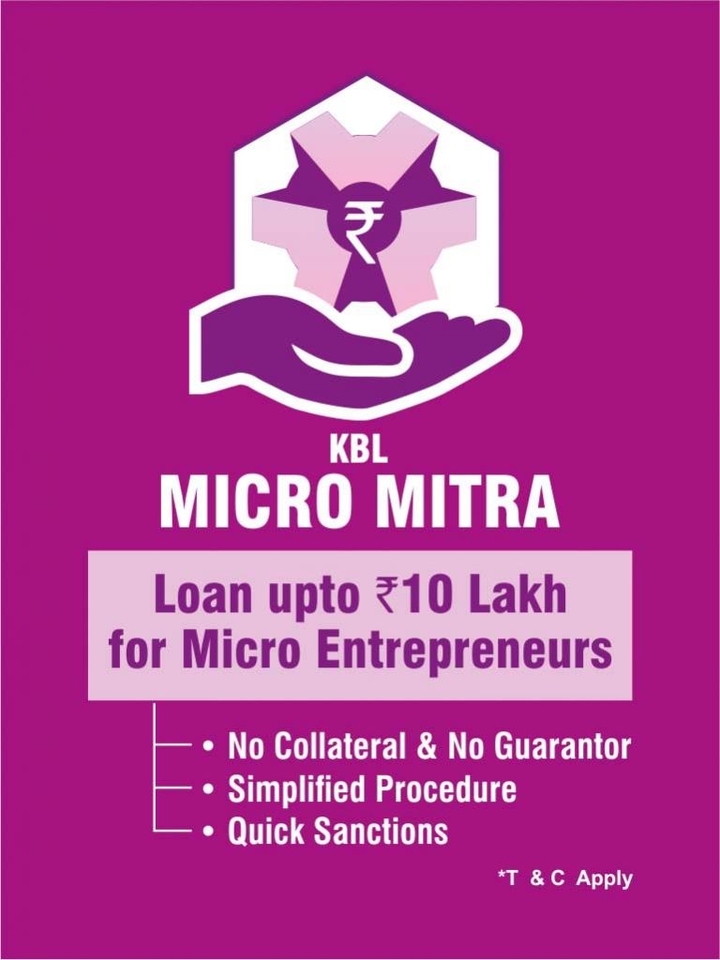

KBL Micro Mitra

- The product has been launched by Karnataka Bank.

- It has been launched for small and micro enterprises.

- It will provide financial assistance of up to Rs.10 lakhs as working capital as well as investment purposes to the enterprises.

- It will have simple procedures and easy rate of interest.

- It can be availed from all the branches of Karnataka Bank across the nation.

Swasth Card

- It has been launched by Yes Bank in collaboration with Fintech healthcare startup Affordplan

- It is a co-branded healthcare card which comes under Swasth program to provide healthcare at discounted rate.

- BANK’s wallet has integrated on Affordplan Swasth to enable wallet QR scan for making payments to merchant partners empanelled on the Affordplan Swasth app

- It needs no documentation

- It is flexible in nature

- Other features: cashbacks, loan facilities, basic insurance cover, KYC within 24 hours etc

SARAL scheme

- ICICI HFC for affordable housing loan in both urban as well as rural areas.

- It is developed for women, lower-middle-income customers, and economically weaker sections who have a maximum annual household income up to Rs 6 lakhs.

- The interest rate will be around 7.98% onwards.

- Loan amount of upto Rs 35 lakh for a tenure of 20 years can be availed.

- Pre-existing loans can also be transferred in SARAL scheme.

Other Important Apps

|

App |

Launched By |

|

RBI |

MANI App |

|

Airtel Money |

Axis Bank + Airtel |

|

Barodapedia |

Bank of Baroda |

|

Branch on wheels in Odisha |

ICICI Bank |

|

Batuaa App |

Oriental Bank of Commerce |

|

Chillar App |

HDFC Bank |

|

DiYA |

Canara Bank |

|

DLite |

Karur Vysya Bank |

|

eMPower |

Allahabad Bank |

|

e-Infobook |

Canara Bank |

|

e-Purse |

Corporation Bank |

|

EASE |

Corporation Bank |

|

Freedom |

State Bank of India |

|

GO Mobile+ |

IDBI Bank |

|

GENIE |

Punjab National Bank |

|

iMuseum |

ICICI Bank |

|

iStudio Voice |

ICICI Bank |

|

iTravelSafe |

ICICI Bank |

You will get

- 300+ Interactive Live Classes for complete conceptual clarity

- 10000+ Practice Questions covering all levels of difficulty

- 80+ Full-Length Mock Tests d. Full coverage of Current Affairs, Banking Awareness, and Financial Awareness

Are you tired of purchasing different types of mock tests for various exams? Well, not anymore! Try BYJU’S Exam Prep Test Series and get full access to 700+ mock tests of all banking and insurance exams. Attempt free mock test now!

All the best!