IRS Exam: Eligibility, Exam Pattern, Syllabus, Salary

By BYJU'S Exam Prep

Updated on: November 14th, 2023

IRS or the India Revenue Service is a Group-A service under the Civil Services. India Revenue Service (IRS) is one of the three All India Services. The IRS is the administrative revenue service under the Government of India. It functions under the Department of Revenue, Ministry of Finance. Millions of Indians dream to clear the IRS Exam but only a few succeed. The IRS notification 2023 was released on the official site on 01 February 2023, as per which the application process took place from 01 February onwards, and the last date to apply online was 21 February 2023.

To become an IRS officer, one needs to clear all stages of the UPSC Exam. Let’s take a brief look at the eligibility, IRS syllabus, and other information related to the exam. It consists of three stages – Prelims, Mains, and Interview. Applicants who wish to join IRS must clear all the stages of the CSE Exam.

Table of content

-

1.

What does an IRS do?

-

2.

IRS Exam

-

3.

IRS Exam Overview

-

4.

IRS Exam Date 2023

-

5.

IRS Exam Eligibility

-

6.

IRS Age Limit

-

7.

How to apply for IRS Exam 2023?

-

8.

How to Become an IRS Officer?

-

9.

How to Prepare for the IRS Exam?

-

10.

IRS Exam Pattern

-

11.

IRS Syllabus for Prelims Paper 1

-

12.

IRS Syllabus for Prelims Paper 2 CSAT

-

13.

IRS Syllabus for Mains

-

14.

IRS Exam Admit Card

-

15.

IRS Training

-

16.

IRS – Designations in the Service for IRS (IT)

-

17.

IRS – Designations in the Service for IRS (C&IT)

-

18.

IRS Officer Salary

-

19.

IRS Result 2023

What does an IRS do?

The IRS is primarily responsible for administering direct and indirect taxes accruing to the Government of India and collecting taxes. The Indian Revenue Service comprises of two services, the Indian Revenue Service (Income Tax) and the Indian Revenue Service (Custom & Indirect Taxes). The IRS (IT) is controlled by the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC) is the statutory body for the IRS (C&IT).

The duties of the IRS (IT) include policy formulation on tax reforms, policy matters in respect of the investigation of tax evasion, administering direct tax policies, etc. Whereas the C&IT job profile includes formulation and enforcement of policies related to GST, administration of matters related to Customs and Narcotics, prevention of smuggling, etc.

IRS Exam

The IRS Exam, like the IAS Exam is conducted by the Union Public Service Commission. As mentioned earlier, the IRS exam is a part of the Civil Services Examination, and the conducting body is the UPSC.

To qualify for IRS Exam, one needs to clear all the three-level, i.e., Prelims, Mains, and Interview. Once qualified, the candidate is allotted the service according to their rank and preference disclosed in the DAF. IRS officers recruited through UPSC are called direct recruits.

IRS Exam 2023 Notification

The notification of the IRS Exam 2023 was released on 01 February 2022 on the UPSC website. The IRS Exam 2023 Prelims will be conducted on 28 May 2023.

- UPSC notification 2023 is released on 01 February 2023

- Interview Dates: 30 January 2023 onwards

- Mains Exam Date 2022: 16 September to 25 September 2022

- UPSC Mains 2022 Admit Card released on 30 August 2022

IRS Exam Overview

| India Revenue Service | |

| IRS Full-Form | IRS stands for Indian Revenue Service. The recruits selected in this are known to be IRS Officers. It is one of the Group A services under the UPSC. |

| Exam conducting body | Union Public Service Commission |

| Officer Training Centres | National Academy of Customs Indirect Taxes and Narcotics (NACIN) at Faridabad, Haryana, and National Academy of Direct Taxes (NADT) in Nagpur, Maharashtra. |

| Who can become an IRS Officer? | The IRS Eligibility has similar eligibility criteria as other services mentioned under the UPSC Notification. Candidates who hold a valid graduate degree from a recognized university and are within the Age limit can apply for the exam. |

IRS Exam Date 2023

IRS Exam Date 2023 is released in the notification. The Prelims exam will take place on 28 May 2023. Aspirants who want to become Indian Revenue Service officers must start their preparations from now to score well in the exam.

The IRS Exam 2023 prelims will be conducted by UPSC on 28 May 2023 in two shifts:

- Shift 1 – General Studies Paper-1: 9:30 A.M to 11:30 A.M.

- Shift 2 – General Studies Paper-2 (CSAT): 02:30 P.M. to 04:30 P.M.

| Events | Dates |

| IRS Exam Notification – Release Date | 01 February 2023 |

| IRS Exam Application Date | 01 February 2023 |

| IRS Exam Last Date of Application | 21 February 2023 |

| UPSC IRS Exam Date 2023 – Prelims | 28 May 2023; Sunday |

| UPSC IRS Exam Date 2023 – Mains | 15th September 2023 onwards |

IRS Exam Eligibility

There is no physical requirement needed in IRS, as in the case of IPS. UPSC Eligibility is released in detail in the UPSC CSE Notification. The complete IRS qualification and eligibility requirements include:

- IRS Exam Age Limit

- IRS Educational Qualifications

- Nationality

IRS Age Limit

The UPSC calculates age as of 1st August of the year in which the UPSC Exam is conducted. The minimum age limit to sit for the IRS Exam is 21 years. Even the upper age for the IRS Exam is calculated as of 1st August.

For general category candidates, the upper UPSC Age Limit is 32 years. The upper age limit prescribed is relaxable up to a maximum of five years if the candidate belongs to a Scheduled Caste or a Scheduled Tribe. For an OBC candidate, a relaxation of 3 years is mentioned, making the maximum age to sit for the UPSC Exam to be at 35 years.

IRS Exam Qualification

The educational requirements required to sit for the IRS are:

- The candidate must hold a Bachelor’s degree from a recognized university or board or should have an equivalent qualification.

- Candidates who are in their last year of graduation are also eligible for IRS Exam as well.

IRS Exam Nationality

For IRS, a candidate must be either:—

(a) a citizen of India or

(b) a subject of Nepal, or

(c) a subject of Bhutan, or

(d) a Tibetan refugee who came over to India before 1st January 1962 with the intention of permanently settling in India, or

(e) a person of Indian origin who has migrated from Pakistan, Burma, Sri Lanka, East African countries of Kenya, Uganda, the United Republic of Tanzania, Zambia, Malawi, Zaire, Ethiopia and Vietnam with the intention of permanently settling in India.

How to apply for IRS Exam 2023?

As discussed earlier, the IRS Exam is conducted by the UPSC. UPSC releases the IRS Exam application form every year and the candidates eligible can fill up the application form on the official website of UPSC. It is always advised for the candidates to go through all the necessary details mentioned in the UPSC Notification before filling up the exam form online.

To apply, the candidate must:

- Visit the official website of UPSC.

- Then go to the Examination Tab, and select ‘Active Examination’.

- Click on Civil Services (Preliminary) Examination.

- Click on the ‘Apply’ option.

- Fill in all the required information and upload your latest photo and signature according to the desired size and file format.

- Once filled, preview the application form, save a copy for your reference, and then submit.

How to Become an IRS Officer?

To become an IRS Officer, one needs to clear all three stages of the UPSC Exam. The UPSC Exam is conducted by the Union Public Service Commission. Only when a candidate clears all the stages and secures a decent rank, he/she becomes eligible to be an IRS Officer.

After applying for the UPSC IRS Officer Exam, the eligible candidates sit for the UPSC Prelims. Upon clearing the UPSC Cutoff, the selected candidates are then admitted to sit for the UPSC Mains, followed by only selected candidates sitting for the interview. The UPSC IRS Officer Exam is conducted in three stages:

- Prelims

- Mains

- Interview

IRS Exam Application Fee

IRS candidates are required to pay a fee of Rs. 100/- (Rupees One Hundred only) either by remitting the money in any Branch of State Bank of India or by using Visa/Master/RuPay Credit/Debit Card or by using an Internet Banking of SBI. Female/SC/ST/Persons with Benchmark Disability Candidates are exempted from payment of the fee.

Applicants who opt for the “Pay by Cash” mode should print the system-generated Pay-in-slip during part II registration and deposit the fee at the counter of the SBI Branch on the next working day only.

How to Prepare for the IRS Exam?

The IRS Exam is the same as the IAS Exam. The Commission conducts a single exam to recruit candidates for all the services mentioned in the UPSC Notification. There are no pre-required requisites for the IRS Exam. One needs to read all the NCERT Books for UPSC, UPSC Books, and books related to one’s optional subject to sail through the exam.

IRS Exam Pattern

The IRS Exam is designed to test the overall intellectual and critical traits of the candidate appearing for the exam. It also tends to understand the overall understanding level of the candidates.

The IRS exam is conducted in three stages by the UPSC, viz., Prelims, Mains, and Interview. The aspirants must understand the UPSC Exam Pattern and with a strategic approach, fetch good marks in each stage of the IRS exam.

IRS Exam Pattern – Prelims

The IRS Exam Pattern for Prelims consists of two papers, GS Paper 1 and GS Paper 2 (CSAT). Both the papers for Prelims are objective (MCQ) in nature. Paper-2 or CSAT is qualifying in nature with 33%. Each paper carries 200 marks, and the time duration for both papers is 2 hours each. The merit list of Prelims is decided on the basis of marks scored in GS Paper 1 only.

IRS Exam Pattern – Mains

The IRS Exam Pattern for Mains includes 9 papers in total. The first two papers, Compulsory Indian Language and English are qualifying in nature. Other than this, the main papers include 1 Essay paper, 4 General Studies Paper, and 2 papers on the Optional Subjects.

- Paper A- Compulsory Indian Language

- Paper B- English

- Essay

- General Studies- 1 (Indian Heritage & Culture, History & Geography of the World & Society)

- General Studies- 2 (Governance, Constitution, Polity, Social Justice & International Relations)

- General Studies- 3 (Technology, Economic Development, Biodiversity, Security & Disaster Management)

- General Studies- 4 (Ethics, Integrity & Aptitude)

- Optional Subject- Paper 1

- Optional Subject- Paper 2

IRS Exam Pattern – Interview

Once the candidate has cleared the Mains level, just take a deep breath and pat yourself on the back. You have won half the battle. For IRS Interview, prepare your DAF Really well. Make notes and pointers on all questions asked in the DAF. The majority of the questions arise from the Detailed Application Form. They form the base of your IRS Interview.

The second part of the IRS Interview consists of questions based on your service preference. For IRS, questions may generally arise from recent financial amendments in India, GST, direct and indirect taxes, India’s position on a global level, etc.

IRS Syllabus for Prelims Paper 1

The candidates are advised to go through the UPSC Prelims Syllabus for the Preliminary Examination and prepare accordingly. The topics for IRS Exam- Prelims include:

- Current events of national and international importance.

- History of India and Indian National Movement.

- Indian and World Geography-Physical, Social, Economic Geography of India and the

- World.

- Indian Polity and Governance-Constitution, Political System, Panchayati Raj, Public Policy, Rights Issues, etc.

- Economic and Social Development-Sustainable Development, Poverty, Inclusion,

- Demographics, Social Sector Initiatives, etc.

- General issues on Environmental ecology, Bio-diversity, and Climate Change – that do not require subject specialization.

- General Science.

IRS Syllabus for Prelims Paper 2 CSAT

The candidates are advised to go through the UPSC Prelims Syllabus for the Preliminary Examination and prepare accordingly. The topics for IRS Exam- Prelims CSAT Syllabus include:

- Comprehension;

- Interpersonal skills including communication skills;

- Logical reasoning and analytical ability;

- Decision-making and problem-solving;

- General mental ability;

- Basic numeracy (Class X level),

- Data interpretation

IRS Syllabus for Mains

The candidates are advised to go through the UPSC Mains Syllabus published in this section for the Mains Examination. The questions in the IRS Exam for Mains test the candidate’s basic understanding of all relevant issues, and their ability to analyze, views on conflicting socio-economic goals, objectives, and demands. The topics include:

IRS Syllabus for Qualifying Paper – English

- Comprehension of given passages

- Precis Writing

- Usage and Vocabulary

- Short Essays

IRS Syllabus for Qualifying Paper – Indian Language

- Comprehension of given passages

- Precis Writing

- Usage and Vocabulary

- Short Essays

- Translation from English to the Indian Language and vice-versa

IRS Essay Syllabus

Candidates are required to write essays on a total of two topics, selecting one from each section.

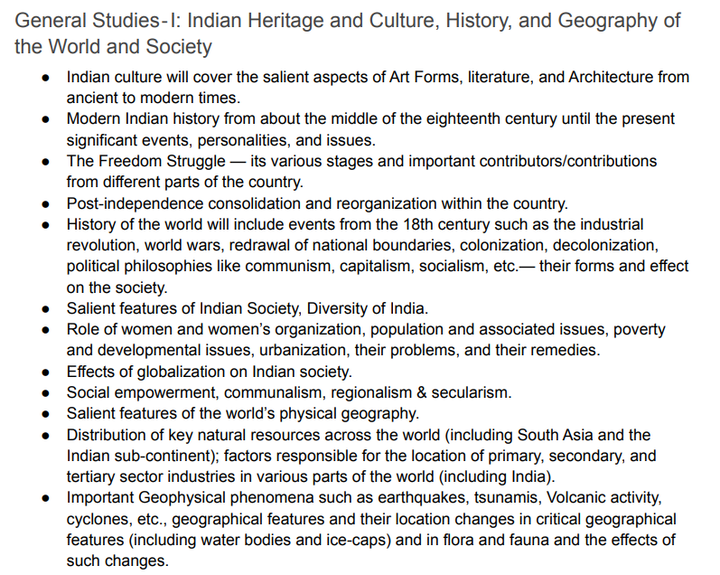

IRS Syllabus for Mains General Studies 1

The IRS Exam Syllabus for Mains is similar to UPSC Mains Syllabus. The GS Paper 1 includes History, Indian Art and Culture, Geography, and Indian Society.

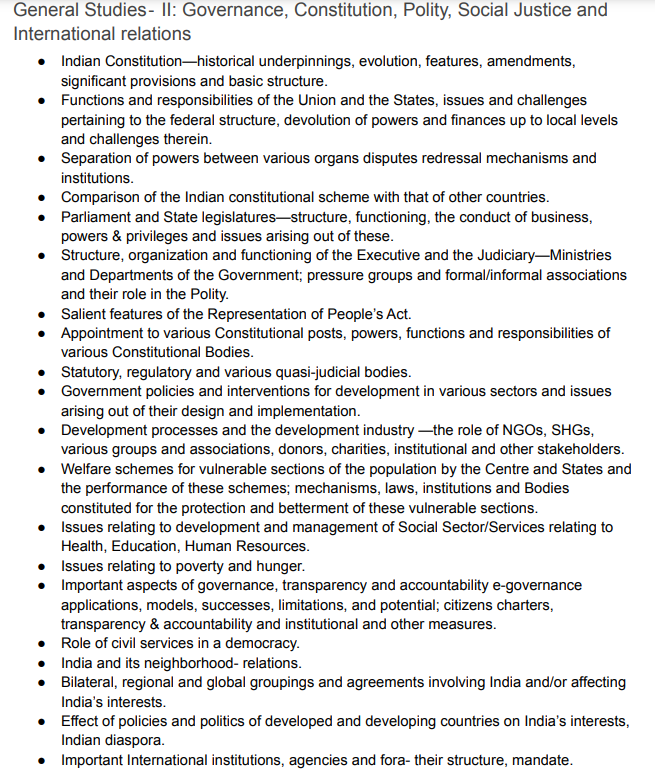

IRS Syllabus for Mains General Studies 2

The IRS Mains Syllabus for GS 2 includes Polity, Governance, IR, and more. The UPSC IRS Mains Syllabus for GS Paper 2 has a good overlap with Political Science and International Relations UPSC Syllabus.

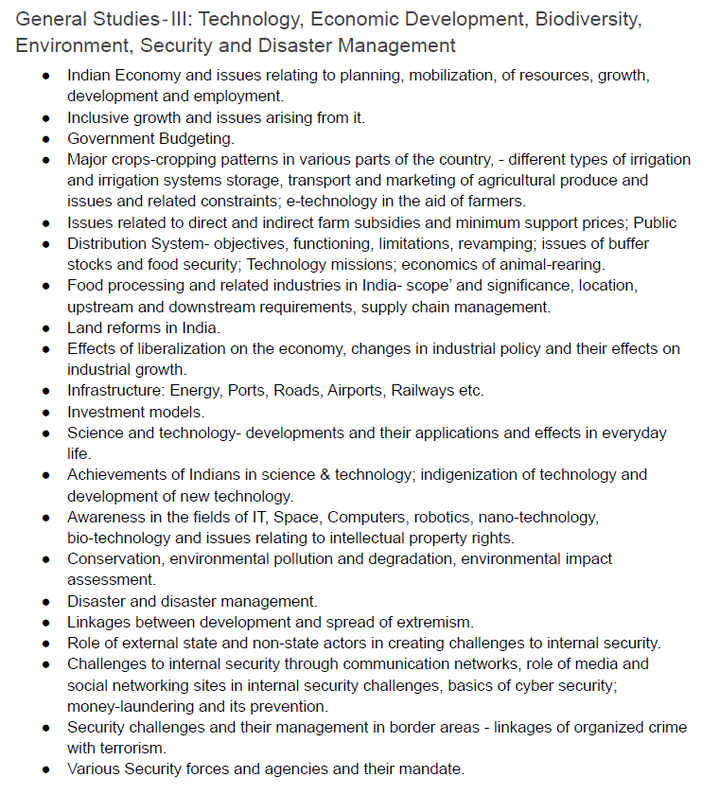

IRS Syllabus for Mains General Studies 3

The IRS Exam Syllabus for Mains is similar to UPSC Mains Syllabus. The GS Paper 3 includes Technology, Economic Development, Biodiversity, Environment, Security, and Disaster Management. The GS Paper 3 can be easily covered through Current Affairs and the economic development part through the Economy Notes for UPSC.

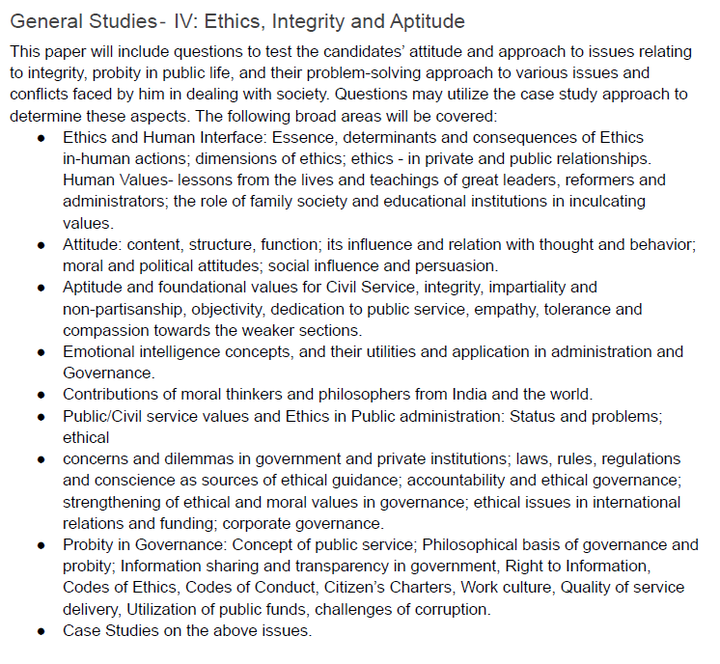

IRS Syllabus for Mains General Studies 4

The IRS Exam Syllabus for Mains is similar to UPSC Mains Syllabus. The GS Paper 4 includes Ethics, Integrity, and Aptitude, and all of these topics can be easily covered if one refers to the Ethics Books for UPSC.

IRS Syllabus for Optional Subject Papers 1 and 2

Candidates can choose any optional subject from amongst the List of Optional Subjects given in the UPSC Notification. The UPSC has 48 optionals subjects in total. Learn How to choose Optional Subject for UPSC to make the correct choice.

IRS Exam Admit Card

IRS Exam Admit Card for Prelims is generally released a few weeks before the exam by UPSC on their official website. Candidates who have successfully registered for the UPSC Prelims Exam will be able to download the IRS admit card from the website.

IRS Exam Admit Card for Mains is released after the Prelims result is out and a few weeks before the Mains Exams. Candidates who have cleared the UPSC Prelims will only be able to download the admit card.

It is of utmost importance that the candidate carries the admit card to his/her exam center, along with valid ID proof. Not compelling to this may lead to denial of his/her appearance for the Exam.

IRS Training

After selection, IRS candidates are sent to Lal Bahadur Shastri National Academy of Administration (LBSNAA) in Mussoorie for a 3-month-long Foundation Course. During this tenure, they are allotted their service preference.

The selected IRS (C&IT) OTs undergo specialized training at the National Academy of Customs Indirect Taxes and Narcotics (NACIN) at Faridabad, Haryana, whereas IRS (IT) OTs undergo a 16-month specialized training at the National Academy of Direct Taxes (NADT), in Nagpur, Maharashtra.

IRS Officers also undergo training with the IPS officers at National Police Academy, Hyderabad, and the Indian Army. NADT and NACIN both have also signed a Memorandum of Understanding with the NALSAR, Bengaluru to award postgraduate diplomas in business laws to the OTs of both branches.

Apart from these, there are many mid-career training programs (MCTP) for IRS officers depending on their ranks and seniority.

IRS – Designations in the Service for IRS (IT)

The designations within the Indian Revenue Service (IRS) are as follows:

- Assistant Commissioner of income tax / Entry-level (Probationer)

- Deputy Commissioner of income tax

- Joint Commissioner of income tax

- Additional Commissioner of income tax

- Commissioner of income tax/additional director general

- Principal Commissioner of income tax

- Chief Commissioner of income tax or director-general

- Principal Chief Commissioner of income tax, CBDT chairperson, member of CBDT, and director-general of the Central Economic Intelligence Bureau

IRS – Designations in the Service for IRS (C&IT)

The designations within the Indian Revenue Service (IRS) are as follows:

- Assistant Commissioner of Central GST/Customs (entry-level; probationer)

- Deputy Commissioner of Central GST/Customs

- Joint Commissioner of Central GST/Customs

- Additional Commissioner of Central GST/Customs

- Commissioner of Central GST/Customs and Additional Director General

- Principal Commissioner of Central GST/Customs

- Chief Commissioner of Central GST/Customs and Director-General

- Principal Chief Commissioner of Central GST/Customs, CBIC chairperson, Member of CBIC, and Director-General.

IRS Officer Salary

After clearing all the stages of the UPSC Exam, the selected IRS Officers join their respective services as Assistant Commissioners. As Assistant Commissioner (probationer), he/she receives an IRS Salary on the pay scale of INR 15,600 – 39100 on the Grade Pay of INR 5400. As Joint Commissioner on the pay scale of INR 15,600 – 39100 on the Grade Pay of INR 7600. The maximum/upper limit pay scale is fixed at INR 80000 for an IRS Officer’s Salary Per Month.

☛ To become IRS Officer, Read Current Affairs Daily

IRS Result 2023

The official authorities of the Union Public Service Commission will declare the final result for the 2022 recruitment process soon. Earlier, officials released the UPSC mains result 2022 on 6th December 2022. The candidates who appeared in the mains exam can check the result. UPSC result PDF comprises the roll numbers of all the candidates who are qualified for the next level of the exam.