Capital Adequacy Ratio – CRAR: Ratio, Formula, CRAR Full Form

By BYJU'S Exam Prep

Updated on: November 14th, 2023

Capital Adequacy Ratio is known as Capital to Risk (Weighted) Assets Ratio (CRAR). In other words, it is the proportion of a bank’s capital to its current and risk-weighted liabilities. This ratio is used to receive cash and improve the effectiveness and stability of financial systems worldwide. The CRAR evaluates a bank’s capacity to pay obligations, respond to operational and financial concerns, and set bank rules. An organization with a high Capital Adequacy Ratio has enough capital to cover losses.

CRAR is an important topic in the Indian Economy Syllabus, and aspirants must have comprehensive knowledge of this topic for the upcoming UPSC Exam.

Table of content

Capital Adequacy Ratio

Capital Adequacy Ratio is a bank’s fund proportion to its current obligations and risk-weighted assets.

- This CRAR protects depositors and improves the efficiency and stability of financial systems worldwide.

- Businesses should utilize CRAR Ratio since it can boost employee productivity and cut costs. Businesses have been shown to benefit from CRAR in many ways.

- The capital adequacy must be at least 10.5% (including the capital conservation buffer). The recommendation for a cash reserve buffer is made to help banks accumulate capital they could employ during pressure.

- Banks’ loans and other assets are effectively weighted (i.e., multiplied by a percentage factor) to reflect their respective levels of risk of loss to the bank. This is what is meant by risk-weighted assets.

- Risk weight is the number of money banks must keep aside for large loans as required by the Reserve Bank of India for bankers or the National Housing Bank for housing finance companies.

- Capital Adequacy Ratio is comparable to leverage; in its simplest form, it is the opposite of debt-to-equity leverage formulations (although CAR uses equity over assets instead of debt-to-equity; since purchases are by definition equal to debt plus equity, a transformation is required). In contrast to conventional leverage, CRAR understands that asset classes can have different amounts of risk.

CRAR Full Form

CRAR Full Form stands for Capital to Risk (Weighted) Assets Ratio. It is a bank’s capital proportion to its current obligations and risk-weighted assets. Central banks and bank regulators decide to stop commercial banks from using excessive leverage and going bankrupt.

CRAR in Banking

To guarantee that banks have sufficient protection against loss before they become bankrupt and lose depositor money, minimum capital ratios (CARs) are crucial.

- By lowering the risk of bank insolvency, CRARs promote the effectiveness and sustainability of a country’s financial system.

- A bank is widely seen as secure and much more likely to meet its financial commitments if it has a high Capital Adequacy Ratio.

- Account holders can lose their savings if a bank experiences a loss that surpasses the capital it has on hand since creditor funds are prioritized over the bank’s capital throughout the winding-up process.

- Consequently, the greater the depositors’ funds are safeguarded, the higher the bank’s Capital Adequacy Ratio.

- Credit risks also exist concerning off-balance sheet transactions like contracts for foreign exchange and guarantees.

- These risks are weighted similarly to on-balance sheet credit risks after being translated to their credit equivalent figures. The overall risk-weighted credit exposure is calculated using an off-sheet and on-balance sheet credit risk exposure.

- A bank with a high CRAR is considered solid and ready to fulfil its financial obligations in all contemplations.

- The Reserve Bank of India highlights that the bank is properly resourced and that its financial condition still is stable.

- As of December 31, 2022, the CRAR Ratio stands at 16.47%.

Example of CAR Usage

- Under Basel II and Basel III, the minimum threshold capital to risk-weighted assets is 8% and 10.5%, respectively.

- High Capital Adequacy Ratios surpass Basel II and Basel III’s minimum standards.

CRAR Ratio: Significance

The ratio of a bank’s capital to the given risk is known as the Capital Adequacy Ratio (CAR), sometimes referred to as the capital to risk (weighted) assets ratio (CRAR).

- To make sure a bank can tolerate a reasonable level of loss and conforms with statutory financial regulations, regulatory agencies check its CRAR.

- It serves as a measure of bank capital. In terms of a company’s risk-weighted credit exposures it is expressed in a percentage. The aim of enforcing this CRAR ratio’s mandated levels is to protect depositors and advance global financial institutions’ stability and efficiency.

- Two forms of capital assessed are Tire 1 and Tire 2. Tier 1 capital can also absorb losses without requiring a bank to stop operating. Tier 2 capital can absorb damages in the case of a winding-up but provides less protection to customers.

- The Capital Adequacy Ratio is a statistic that assesses a bank’s capacity to meet its short-term obligations and other concerns, including operational and credit risk. In its basic form, capital acts as a “cushion” against potential losses and protects depositors and other lenders. Banking regulators in most nations define or oversee CAR to safeguard customers and uphold public confidence in the banking system.

- The importance of minimum Capital Adequacy Ratios in keeping banks from going bankrupt and losing depositor money is emphasized by their capacity to withstand reasonable losses.

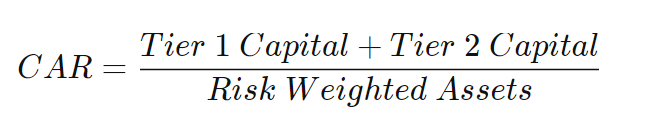

CRAR Formula

By splitting the bank’s capital by its total risk-weighted liabilities for credit risk, operational risk, and market volatility, the CAR or CRAR is computed.

- A bank’s tier 1 capital and tier 2 capital are summed, and the total is divided by all its risk-weighted assets. Which would be:

- (Eligible Tier 1 capital funds) = (Market Risk RWA + Credit Risk RWA + Operational RWA). It is also known as the Tier 1 CAR.

- Total CAR equals the sum of (Eligible Total Investment Capital) + (Credit Risk RWA + Market Risk RWA + Risk Assessment RWA).

- Risk-weighted assets divided by (Tier 1 capital plus Tier 2 capital) is indeed the CAR formula.

One will see that two different capitalizations are measured in the above CRAR formula.

- Tier 1: capital enables a bank to absorb losses without halting trade. Ordinary share capital, equity capital, audited income reserves, and intangible assets compensate for what is known as core capital. This is money that is constantly accessible and can be utilized by banks to absorb losses quickly without closing.

- Tier 2: Depositors are less protected by capital because they can absorb losses if a bank winds up. Unaudited reserves, unaudited dividend income, and general loss reserves make up this amount. This capital absorbs losses when a bank loses all its tier 1 capital and protects against them when it shuts down.

Benefits of CRAR

The benefits of CRAR are as follows:

- To stop commercial banks from taking on more debt and going broke, central banks and bank regulators set the CRAR in banking,

- The CAR is required to ensure that banks have sufficient breathing room to take a reasonable loss level before declaring bankruptcy and losing depositor money.

- High CRAR/CAR banks are seen as safe, healthy, and able to fulfil their financial obligations.

- Depositors will only forfeit their deposits if the bank experiences a loss bigger than its capital, which eventually ends up since depositor funds take priority over the total cash and cash equivalents.

- Therefore, the safety offered by the bank to customers’ funds depends on how high the CAR becomes.

- By reducing the risk of bank bankruptcy, the CRAR helps keep a country’s economic banking markets healthy.

Limitations of Using Capital Adequacy Ratio

The Capital Adequacy Ratio’s failure to account for predicted losses during a bank run or financial crisis, which can affect a bank’s capital and money costs, is just one of its limitations.

- Many analysts and bank executives regard the economic capital measure as a more precise and reliable indicator of a bank’s financial soundness and risk exposure than the adequacy ratio.

- Economic capital is measured by calculating the amount of money a bank should have to ensure it can handle its current outstanding risk. This calculation is based on the bank’s economic stability, credit rating, expected losses, and liquidity level.

- This measure is said to provide a more accurate assessment of a bank’s actual financial risk and health level because it considers basic economic realities as expected losses.

Risk-Weighted Assets in CRAR

Assets or off-balance-sheet assets weighted according to risk are known as risk-weighted or RWAs. This asset calculation calculates a financial bank’s capital requirement or Capital Adequacy Ratio (CRAR). The Committee on Banking Supervision explains why utilizing a risk-weight approach is the preferred methodology banks should use for capital calculation in the Basel I accord that was released either by the Committee:

- It offers a simpler way to compare banks in various regions

- Calculating capital adequacy may be ready with off exposures

- Banks are not barred from keeping fluid, low-risk assets on their records

Varying asset types usually have different risk acts provided to them. Whether the bank has taken the standardized or IRB method underneath the Basel II framework will affect how risk weights are computed.

Capital Adequacy Ratio UPSC

The Capital Adequacy Ratio established guidelines for banks by assessing each institution’s capacity to meet its obligations and respond to operational and credit risks. A bank with a strong CRAR has sufficient capital to cover any losses. It is therefore less likely to go bankrupt and lose the money of its depositors.

CRAR is an important topic in the Indian Economy and is comprehensively covered in Economics Books for UPSC. Candidates preparing for the UPSC IAS Exam must be updated with the latest CRAR as updated by Reserve Bank of India.

CRAR UPSC Questions

Question: Which of the below-penned statements is/are true concerning the Capital Adequacy Ratio or CRAR?

- CRAR is a capital amount that banks must sustain as their funds to balance any loss incurred due to account holders’ failure to repay dues.

- Each bank decides its CRAR individually.

Choose the correct answer:

- Only A is true

- Only B is true

- A and B are true

- A and B are false

Answer: Option A

Question: Consider the following statements:

1. Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital in relation to its risk-weighted assets and current liabilities.

2. The risk-weighted assets consider credit, market, and operational risks.

Which of the above statement(s) is/are correct?

- Only 1

- Only 2

- Both 1 and 2

- None of the above

Answer: Option C