Dear Aspirants,

Today we are posting an article on BASEL Norms. This article is important for the upcoming UGC NET exam. We hope this will help you in your exam preparation.

1. Overview of BASEL Norms

- The Basel Committee on Banking Supervision (BCBS) was formed in 1974 by a group of central bank governors of G-10 countries.

- Later on, the committee was expanded to include members from nearly 30 countries. BCBS in 1988 released Basel-I accords and subsequently to overcome the loopholes in it Basel–II was released in 2004.

- BCBS released a comprehensive reform package in Dec 2010, which is called as Basel–III, a global regulatory framework for more resilient banks and banking systems. These recommendations cover almost all nations. And it amends the Basel-2 guidelines, also introduces some new concepts and recommendations.

2. Understanding Basel

First, why these norms are needed in the first place? The answer to this question is "to manage the risks undertaken by banks and regulate sound banking structure worldwide"

Banks mainly deals with three kinds of risks. These are

- Credit risk - It is basically the risk of loss, arising when a borrower is not capable of paying back the loan as promised. Such borrowers are also known as Sub-prime borrowers.

- Market risk - The Market risk is the risk that the value of an asset will decrease due to changes in market factors. For Banks, market risk is a risk that the value of 'on' or 'off' balance sheet positions will be adversely affected by movements in equity and interest rate markets, currency exchange rates and commodity prices. It is also called “systematic risk” because it relates to factors, such as a recession, that impact the entire market.

- Operational risk - Operational risk is the prospect of loss resulting from inadequate or failed procedures, systems or policies, Employee errors, Systems failures, Fraud or other criminal activity, Any event that disrupts business processes.

Now, here is how and from where Basel Norms III came:

- During the global financial crisis of 2007-08 problems faced by certain large and highly interconnected financial institutions hampered the orderly functioning of the financial system, which in turn, negatively impacted the real economy.

- Many large financial institutions collapse, bankrupt which result in prolonged unemployment. In September 2008, America’s fourth-largest investment bank Lehman Brother collapsed triggering one of the worst financial crisis in recent history.

- The Basel II framework was completely new during the global financial crisis occurred in 2007-2008. However, the crisis made it necessary to fundamentally revise the Basel regulatory framework, paving the way for Basel III.

- In November 2011, The Basel Committee on Banking Supervision (BCBS) came out with a framework to safeguard the interests of the public and to reduce the probability of failure of big banks.

- The Basel Committee framed a new set of international standards, to review and monitor the capital adequacy of banks which collectively called Basel III norms.

Note:

- Banks require capital to meet the unpredictable losses that crop up during their normal lapse of operations. These standard norms collate a bank’s assets with its capital to check whether a bank can withstand during the time of crisis or not.

- The capital requirements are constricted by the Basel III framework that restricts the type of capital that a bank may accommodate in its different capital tiers and structures.

- The different tiers of a bank’s capital structure are Tier 2 capital, Tier 1 capital, and common equity tier 1 (CET1) capital.

3. Need for Basel–III in INDIA

- Firstly, The most important reason is that, as India connects with the rest of the world, and as increasingly Indian banks go abroad and foreign banks come on to our shores, we cannot afford to have a regulatory deviation from global standards. Any deviation will hurt us.

- Secondly, if we ought to maintain a low standard regulatory regime this will put Indian banks at a disadvantage in global competition.

Therefore, It becomes important that Indian banks have the cushion provided by this risk management system to withstand shocks from external systems, especially as we deepen our links with the global financial system.

- In India, Basel III regulations have been implemented from April 1, 2013, in phases.

- It was decided to be fully implemented by March 31, 2019, which is further extended to March 31, 2020.

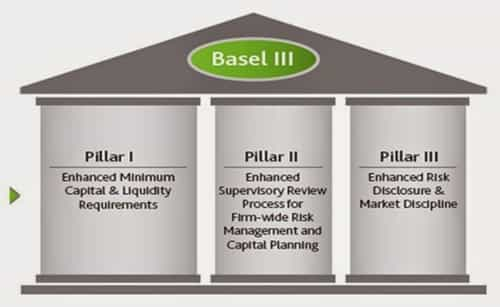

4. Pillars of BASEL Norms

1. Capital adequacy requirements

2. Supervisory review

3. Market discipline

5. Key Concepts/terms under Basel–III

a. Capital Adequacy Ratio (CAR), also known as Capital to Risk (Weighted) Assets Ratio (CRAR), is a ratio of a bank’s capital to its risk. Capital is the money, a bank receives in exchange for issuing shares. This capital is further classified into two – Tier 1 and Tier 2 capital.

b. Risk-Weighted Assets (RWA)- Every bank assigns its assets some weight-age based on the risk involved. Thus, apply a weight percentage to each of its assets.

For example–

- Let's say a bank lends Rs 100 to a person for a home loan and Rs 100 to a person to start a new company.

- Bank's total asset = Rs 100 + Rs 100 = Rs 200

- Let's imagine the home loan has a high probability of being repaid than the loan to a person to start a company.

- i.e. Risk Weight of Home Loan = 50% and Risk Weight of loan for company = 90%

- Risk-Weighted Assets of Bank = 50% of 100 + 90% of 100 = 50 + 90 = Rs. 140. So out of total assets worth Rs. 200, Rs. 140 are risk-weighted assets.

- Bank need 9% of RWA as Capital.

- Bank need 9% of 140 = Rs. 12.6 as Capital.

- Means, out of Rs. 200 that a bank lends, Rs. 12.6 must be funded with Capital. Rest, Rs. 187.4 can be from the money that bank borrowing.

c. The leverage ratio, it measures the ratio of banks total assets to the bank’s capital.

Leverage Ratio = Capital/Total Asset

For example-

- If you have Rs. 100 and you invest them and earn a profit of 10% i.e. you have a profit of Rs. 10 on Rs. 100. This is called non-leverage profit.

- Now again you have Rs. 100 and you borrow Rs. 400 and invest Rs. 500, earns a profit of 10% i.e. you earn Rs. 50 on your Rs. 100. This is called leverage profit.

- With Higher leverage, Bank's Profit/Loss = Higher = Higher Risk also!

- So now leverage ratio of 4.5% means for every Rs bank funds itself with, it can lend up to 22.22 Rs.

6. Challenges For Its Implementation In India

1. Capital- A huge estimated, 2.4 lakh crore rupees are required for its implementation in India.

2. Liquidity- During the global crisis of 2008, the apparently strong banks of the world ran into difficulties when the interbank wholesale funding market witnessed a seizure. Thus in the Indian context, it would mean an additional burden of maintaining liquidity along with the SLR requirement.

3. Technology- BCBS is in the process of making significant changes in standard approach for computing RWAs for all three risk areas. Banks may need to upgrade their systems and processes to be able to compute capital requirements based on the revised standard approach.

4. Skill development- Implementation of the new capital accord requires higher specialized skills in banks.

5. Governance- One can have the capital, the liquid assets and the infrastructure. But corporate governance will be the deciding factor in the ability of a bank to meet the challenges. Strong capital gives financial strength, it cannot assure good performance unless backed by good corporate governance.

That’s all for BASEL Norms

Thanks!

Comments

write a comment