- Home/

- Regulatory Bodies/

- Article

GST: One Nation One Tax One Market

By BYJU'S Exam Prep

Updated on: September 11th, 2023

Goods and Services Tax (GST) is one of the biggest indirect tax reforms of India, which was implemented in 2017. This article deals with everything you need to know about GST. Let’s dig deep inside.

Table of content

What is Goods and Services Tax (GST)?

- One-nation, one-tax revolution ‘GST’ was implemented in India on 1st July 2017 through the insertion of the Constitution (122nd Amendment) Bill or 101 amendment act 2016.

- It provided unified common national market for India, boosting foreign investment and “Make in India” campaign.

- It is categorized as an indirect tax levied on the supply of commodities and services.

- In layman’s language, GST is an indirect tax levied on goods and services supply.

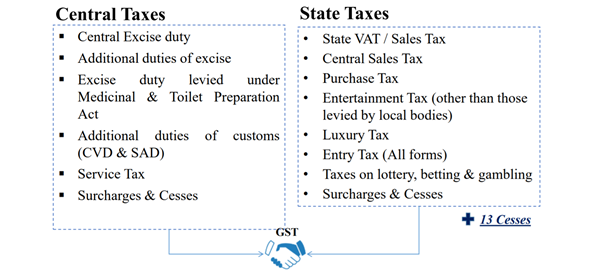

- GST has replaced many indirect tax that existed earlier in India that included the following:

- Excise Duty

- Service Tax

- Entertainment Tax

- Additional Customs Duty

- Surcharges

- State Level VAT

- Octroi Tax

Background of GST

- In 2000, Atal Bihari Vajpayee, the then prime minister of India under BJP lead Government, flags off discussions on the implementation of GST. A committee was set up under the then finance minister of West Bengal, Asim Dasgupta, to design the GST model and put in place the back-end technology and logistics for its implementation.

- Later on, task force chaired by Vijay L. Kelkar, the then advisor to the finance ministry, says the existing tax system is in built with so many problems suggesting a comprehensive GST in 2004.

- Various steps were taken in this direction and union budget 2007-08 fixed April 1, 2010 as the deadline for implementation of the GST.

- In 2009 Pranab Mukherjee, announced the basic structure for GST with a deadline.

- In 2011, Congress party-led government introduced Constitution Amendment Bill in the Lok Sabha to implement GST and India’s opposition parties protest. The bill was sent to a parliamentary standing committee headed by the then finance minister Yashwant Sinha.

- Finally, after a lot of debates and steps, GST was rolled out from 1st July 2017 with the following GST Bills:

- Central GST Bill, 2017

- The Integrated GST Bill, 2017

- Union Territory GST Bill, 2017

- GST (Compensation to States) Bill, 2017

Components of GST

- CGST: It is collected by the Central Government.

- SGST: It is collected by the State Government.

- IGST: It is collected by the Central Government.

Tax Slab of GST

- GST is currently levied in four slabs of 5%, 12%, 18% and 28%.

- Most of the articles that are used daily or are basic in nature have zero GST as per the latest revision of the tax rates.

- 5% of the articles are covered by 18% or lower GST slab.

- Under the previous, value-added tax (VAT) regime, standard taxation rate was much higher in comparison to GST.

- Only luxury and sin goods are taxed at highest 28% GST rate.

- GST rates are calculated based on Harmonized System of Classification Number assigned to the product and the corresponding tax rate.

GST Rates

| 5% GST Tax Slab Items | 12% GST Tax Slab Items | 18% GST Tax Slab Items | 28% GST Tax Slab Items |

| Sugar | Ghee | Biscuits | Waffles and wafers coated with chocolate |

| Tea | Butter | Flavoured refined sugar | Sunscreen |

| Sliced Mango | Fruit juice | Movie tickets priced above ₹100 | Dye |

| Ayurvedic Medicine | Almonds | Monitors and television screens | Hair clippers |

| Skimmed milk | Sugar boiled confectionery | Tyres | Ceramic tiles |

| ICDS Food Packages | 20-litre packaged drinking water bottle | Power banks of lithium ion batteries, small sport related items, video games, carriage accessories for disabled | Wallpaper |

| Milk food for babies | Drip Irrigation System | Washing machine | Dishwasher |

| Edible oils | Biodiesel and select biopesticides | Vacuum cleaner | Automobiles Motorcycles |

| Khakra & Plain Chapati | Mechanical Sprayers | Cakes | Aircraft for personal use |

| Roasted coffee beans | Handbags including pouches and purses | Pastries | Pan masala |

| Packed paneer | Jewellery box | Preserved vegetables | Tobacoo |

| Frozen vegetables | Wooden frames for painting | Soups | Cigarette |

| Cashew nuts | Photographs | Suitcase | Bidis |

| Spices | mirrors etc | Vanity case | Cement |

| Unbranded Namkeen | Ornamental framed mirrors | Briefcase | Yachts |

| Pizza bread | Brass Kerosene Pressure Stove | Chocolates | Weighing machine ATM |

| Rusk | Art ware of iron | Ice cream | Vending machines |

| Sabudana | Hearing aid parts and accessories | Chewing Gum/Bubble Gum | Aerated water |

| Fish fillet | Bamboo wood building joinery | Pasta | |

| Packaged food items | Packed coconut water | Instant food mixes | |

| Fertilizers | Fertilizer-grade Phosphoric Acid | Corn flakes | |

| Footwear upto ₹1,000 | Preparations of vegetables | Curry paste | |

| Apparels upto₹1,000 | Fruits | Mayonnaise | |

| Real Zari | Nuts | Salad dressings | |

| Agarbatti | Pickle | Mixed condiments | |

| Domestic LPG | Murabba | Mixed seasonings | |

| Straw, basketware articles, esparto | Chutney | Branded garments | |

| Velvet Fabric (No Input Tax Refund) | Jam | Footwear priced above ₹500 | |

| Tamarind Kernel Powder | Jelly | Headgear | |

| Mehndi Paste | Namkeen | Soap | |

| Scientific and technical instruments | Bhujia | Hair oil | |

| Floor covering | Frozen meat products | Deodorants | |

| Plastic Waste | Packaged dry fruits | Preparation for facial make-up | |

| Satellites and payloads | Animal fat sausage | Shaving | |

| Ethanol- Solid biofuel pellets | Non-AC restaurants | After-shave items | |

| Handmade carpets and other handmade textile floor coverings | State-run lotteries | Shampoo | |

| Hand-made braids and ornamental trimming in the piece | Exercise books | Washing Powder | |

| Coir mats | Notebooks | Detergent | |

| Rubber Waste | Work contracts | toothpaste | |

| Matting | Apparel above ₹1000 | toiletries | |

| Insulin | Tooth powder | kajal pencil sticks | |

| Paper Waste | Spoons | tissues | |

| Medicines | Umbrella | computers | |

| Stent | Cake servers | printed | |

| Braille watches | Sewing machine | circuits | |

| Braille typewriters | Ladles | printers | |

| Cullet or Scrap of Glass | Forks | monitors | |

| Braille paper | Tongs | camera | |

| Hearing aids | Skimmers | speakers | |

| Postage stamps | Fish knives | CCTV | |

| Biomass Briquettes | Mobile | Electrical transformer | |

| Revenue stamps | Manmade Yarn | Optical fiber | |

| First day covers | Diagnostic kits & reagents | Bidi Patta | |

| Special flights for pilgrims (Economy Class) | Nil Sewing Thread of manmade filaments | Mineral water | |

| Stamp-post marks | Sewing Thread of Manmade Staple Fibres | Tissues | |

| Glasses for corrective spectacles and flint buttons | Poster Colours | ||

| Special flights for pilgrims (Business Class) | Modelling Paste for Children | ||

| Movie tickets priced below ₹100 | Envelopes | ||

| Playing cards | Some parts of pumps | ||

| Ludo | Steel products | ||

| Carom board | Plain Shaft Bearing | ||

| Chess board | Stationery items like clips |

List of items exempted from GST

- Eggs, Honey and Milk Products

- Oil Seeds, Fruit and Part of Plants

- Gums, Resins, Vegetable SAP & Extracts

- Sugar, Jaggery, Honey & bubble Gums

- Tea & Coffee Extract & Essence

- Water, Mineral & Aerated

- Flours, Meals & Pellets

- Salts & Sands

- Fossil Fuels – Coal and Petroleum

- Drugs & Pharmaceuticals

- Fruits and Dry Fruits

Goods & Services Tax Council

- It is constitutional body formed under article 279(a) for making recommendations to the Union and State Government on Goods and Service Tax (GST) issue.

- Members of GST council:

- Chairperson: Union Finance Minister (Current FM – Nirmala Sitharaman)

- Member: Union Minister of State, in-charge of Revenue, Min. of Finance

- Other Members: Minister In-charge of Finance or Taxation or any other Minister nominated by each State Government.

Under the GST regime, CBEC has been renamed as the Central Board of Indirect Taxes & Customs (CBIC) post legislative approval that supervise the work of all its field formations and directorates and assist the government in policy making in relation to GST, continuing central excise levy and customs functions.

GST Data 2022

- Gross GST revenue collected for November 2022: 1,45,867 crores (increase of 11% Year-on Year)

- Monthly GST revenues was recorded more than 1.4 lakh crore for nine straight months in a row

- Revenues from import of goods was 20% higher and revenues from domestic transaction (including import of services) 8% higher than the same month last year.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<