NEER and REER: Definition, Difference and Importance | UPSC Economy Notes

By BYJU'S Exam Prep

Updated on: November 14th, 2023

NEER and REER are indicators of external competitiveness. The Nominal Effective Exchange Rate (NEER), also known as the trade-weighted currency index, measures a nation’s ability to compete in the global foreign exchange (forex) market. The Nominal Effective Exchange Rate (NEER) is adjusted for relative prices or costs to produce the real effective exchange rate (REER), which is reflected in inflation differences between the domestic economy and trading partners. Understanding the concepts of NEER and REER is important for comprehending exchange rate dynamics and their implications on international trade and macroeconomic stability.

NEER (Nominal Effective Exchange Rate) and REER (Real Effective Exchange Rate) are important concepts in economics. These concepts are relevant for understanding how exchange rates impact international trade and the overall economy. These are important topics in the exam, that come under UPSC Syllabus for Economics. Questions on this topic are commonly asked in both prelims and mains. It is important to understand the principles, formulas, and factors that affect these exchange rate measures. By studying and practicing, candidates can enhance their understanding of these concepts and perform well in the UPSC Exam.

Table of content

NEER

The Nominal Effective Exchange Rate (NEER) is a weighted average exchange rate representing the nominal value of one country’s currency relative to a basket of various foreign currencies. The amount of local currency required to buy foreign currency is known as the nominal exchange rate. The NEER measures a nation’s ability to compete internationally in the foreign exchange (forex) market. The NEER is also known as the trade-weighted currency index by forex dealers.

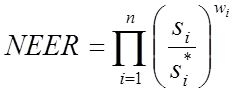

The NEER may be modified to account for the difference between the inflation rates in the home country and its trading partners. The final number is the Nominal Effective Exchange Rate (REER). NEER isn’t based on each currency’s linkages in a nominal exchange rate individually. Instead, it illustrates how the value of one local currency contrasts with several different foreign currencies at once. The Nominal Effective Exchange Rate can be calculated by the formula given below:

REER

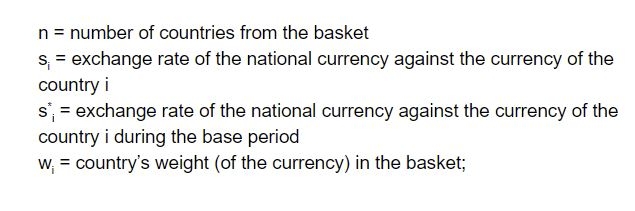

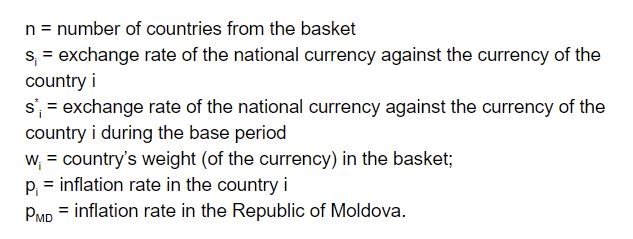

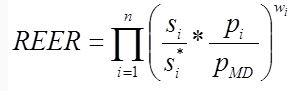

The weighted average of a country’s currency concerning an index or basket of other significant currencies is the Nominal Effective Exchange Rate (REER). The relative trade balance of each country’s currency is compared to the trade balance of every other country in the index to establish the weights. An individual country’s currency value about the other main currencies in the index is determined using this exchange rate. The Nominal Effective Exchange Rate can be calculated by:

NEER vs REER

Indicators of external competitiveness include the Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) indexes. The weighted average of the domestic currency’s bilateral nominal exchange rates in relation to other currencies is known as NEER. The REER, conceptually related to the purchasing power parity (PPP) hypothesis, is defined as a weighted average of nominal exchange rates adjusted for relative price differences between domestic and foreign countries.

- The coverage of NEER/REER indexes for the new base year, i.e., 2015–16, has increased from 36 to 40 currencies due to changes in India’s international trade pattern.

- Eight new nations – Angola, Chile, Ghana, Iraq, Nepal, Oman, Tanzania, and Ukraine—have been included in the 40-currency basket due to changes in the bilateral trade shares of the largest trading partners.

- Argentina, Pakistan, the Philippines, and Sweden are the nations that were removed from the previous 36-currency basket.

- 5.4% of India’s total merchandise trade was with newcomers, compared to 1.4 % with leaving nations.

- As a result, 88% of India’s overall commerce is represented by the new NEER/REER basket as opposed to 84% for the 36-currency basket.

Difference Between Nominal Effective Exchange Rate & Real Effective Exchange Rate

The Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) are two important measures used in economics to evaluate a country’s exchange rate. While NEER reflects the weighted average of a country’s currency relative to other currencies without adjusting for inflation, REER takes into account inflation to provide a more accurate measure of competitiveness in international trade. Check the difference between REER and NEER in detail in the table provided below.

| REER | NEER |

| It displays the home currency’s adjusted value in relation to other significant trading currencies. | It displays how much the home currency is worth in relation to other currencies. |

| It concentrates solely on exchange rate differentials and eliminates the effects of currency-specific inflation differentials. | It has an influence on the difference in inflation rates between the country and its trading partners. |

| It is thought to be a more accurate estimate as a result of being corrected for inflation. | It may provide measurements that are not exactly precise due to differences in inflation, |

| This indicator is trade-weighted and is determined using the NEER. | It is determined using a currency basket. This indicator is trade-weighted. |

Importance of NEER and REER

NEER and REER are of significant importance in economics, especially in the context of exchange rates and global competitiveness. These concepts play a crucial role in analyzing exchange rate dynamics and formulating effective policies. NEER and REER are important for:

- Exchange Rate Analysis: NEER and REER provide insights into a country’s currency value compared to other currencies. They help in assessing the competitiveness of the country’s exports and imports in the international market.

- Policy Formulation: Both play a crucial role in formulating exchange rate policies. Governments and central banks can use these measures to make informed decisions about managing exchange rates, including interventions to stabilize the currency.

- Trade and Balance of Payments: Both are useful indicators for analyzing a country’s trade competitiveness and its impact on the balance of payments. They provide a comprehensive view of a country’s trade position, considering both nominal and real exchange rates.

- Macroeconomic Analysis: Nominal Effective Exchange Rate and Real Effective Exchange Rate are vital tools for macroeconomic analysis. They help economists and policymakers assess the impact of exchange rate fluctuations on various macroeconomic variables, such as inflation, interest rates, investment, and economic growth and development.

- International Financial Stability: Understanding Nominal Effective Exchange Rate and Real Effective Exchange Rate is crucial for maintaining international financial stability. Fluctuations in exchange rates can have implications for capital flows, currency stability, and global economic stability.

NEER and REER UPSC

NEER and REER are important economic concepts for the UPSC Exam. NEER calculates a country’s currency average compared to other currencies, while REER considers inflation to measure competitiveness accurately. These concepts appear in the Economics section of the UPSC Syllabus and are frequently asked in both prelims and mains exams.

Candidates can refer to the detailed information provided above about NEER, REER, and their importance for effective exam preparation. It is also recommended that candidates must refer to Economics Books for UPSC, which will help clarify any doubts regarding the NEER and REER. By studying these topics thoroughly, candidates can be well-equipped to tackle related questions in the UPSC exam.

NEER and REER UPSC Questions

NEER and REER are crucial topics for UPSC exam preparation. Practicing sample questions or previous year’s questions on NEER and REER will provide aspirants with valuable insights into the type of questions that are commonly asked in the exams. It is recommended to engage in such practice to enhance understanding and readiness for the exam

Question: Which of the following methods is commonly used to calculate the NEER? (A) Producer Price Index method, (B) Consumer Price Index method, (C) Laspeyres price index method, (D) Paasche price index method

Answer: (B) Consumer Price Index method

Question: Which of the following measures can be used to improve a country’s NEER? (A) Implementing capital controls to restrict capital outflows, (B) Increasing government spending to stimulate domestic demand (C) Decreasing import tariffs to promote international trade (D) Reducing the country’s foreign exchange reserves

Answer: a) Implementing capital controls to restrict capital outflows

Question: How is NEER different from REER? (A) NEER considers inflation differentials, while REER does not, (B) NEER is a measure of nominal exchange rates, while REER is a measure of real exchange rates, (C) NEER takes into account trade balances, while REER does not, (D) NEER and REER are different terms for the same concept.

Answer: (B) NEER is a measure of nominal exchange rates, while REER is a measure of real exchange rates.

Question: What does NEER stand for in the context of international trade? (A) National Economic Export Rate, (B) Nominal Effective Exchange Rate, (C) Non-Exportable Exchange Rate, (D) National Economic Efficiency Ratio

Answer: (B) Nominal Effective Exchange Rate