Understanding of Financial Market Terms Part 1 + Video concept

By BYJU'S Exam Prep

Updated on: September 25th, 2023

Dear readers,

Today we are presenting you with an article on “Financial Market Terms”. The article is very important for upcoming exams like RBI Grade B, SBI Clerk & Insurance exams. For more clarity of the article, we have provided the link to the ‘VIDEO‘ in which we have discussed the article in a lucid way.

Click here to watch Video on Money Market

Financial Market is the market where borrowing and lending of funds of all individual, institutions, companies and of the government take place.

The products can be classified as – bonds, equities, currencies and derivatives. It is a medium of a channel between depositors and borrowers.

Table of content

Click here to watch Video on Money Market

Dear readers,

Today we are presenting you with an article on Financial Market Terms. The article is very important for upcoming exams like RBI Grade B, SBI Clerk & Insurance exams. For more clarity of the article, we have provided the link to the ‘VIDEO‘ in which we have discussed the article in a lucid way.

Financial Market is the market where borrowing and lending of funds of all individual, institutions, companies and of the government take place.

The products can be classified as – bonds, equities, currencies and derivatives. It is a medium of a channel between depositors and borrowers.

In India, Financial Market can be divided into two main categories:

- Money Market

- Capital Market

Money Market

A money market is a part of the financial market where financial instruments with high liquidity and short-term maturities are traded.

A money market is also known as “Short Term Market” because here the trading is done between 1 day to 365 days.

Due to short-term trading –

- The risk factor is very low.

- As well as “returns are very less.

Short–term instrument like

- Treasury bills

- Commercial papers

- Certificates of deposits, etc. are issued and traded in this market.

Capital Market

A capital market is another part of the financial market where buyers and sellers engage in the trade of financial securities like bonds, stocks, etc.

A capital market is also known as “Long-Term Market because here the trading is more than a year.

Capital market consists of:

- Primary Market

- Secondary Market

1. Primary Market – investors buy securities directly from the company issuing them.

- For e.g. – Initial Public Offering (IPO) issued by any company.

- In the primary market, securities are directly purchased from the issuer.

2. Secondary Market – In the secondary market, the securities issued in the primary market are bought and sold.

- Markets such as Bombay Stock Exchange (BSE), National Stock Exchange (NSE) are secondary markets.

- On the secondary market, small investors have a better chance of buying or selling securities, because they are no longer excluded from IPOs due to the small amount of money they represent.

Debt Instrument

Money invested in fixed income securities (or tool of investment) like Bonds, Treasury Bills, Certificate of Deposits and Commercial paper are classified under Debt instrument. Cash is also considered as a Debt instrument. Return is low in the debt instrument, but the risk is zero.

Note:

- The short-term instrument consists of loans and financial obligations less than one year.

- Long-term debt consists of loans and financial obligations lasting over one year.

Bond

Bond – A “Long-term debt instrument” issued by Government/ company/ banks to raise money from the market have mentioned maturity period and interest rate depending upon amount is known as Bond.

Let us Understand the concept with an example –

Make My Trip (MMT) is a travel and tourism company which aims to expand its business in India.

Let us assume

- Now, to expand the business across India company requires capital of 10 crore rupees.

- To raise capital of 10 crore rupees, MMT will issue long-term debt instrument and invite investors to purchase that instrument.

- The instrument will have certain maturity period and interest rate (either fixed or floating rate).

- Interest rate and maturity period are mentioned in a paper given to the client by MMT.

- For e.g. The maturity period of the debt instrument is 5 Years.

This long-term debt instrument is known as Bond. Since MMT is a private company, so bond issue by MMT is called Corporate Bond.

Treasury Bill (T-Bills)

It is a short-term debt instrument. T-Bills are issued by the Government of India and auctioned by RBI.

- Treasury Bills are presently issued three maturities, namely, 91 days, 182 days and 364 days.

- Treasury bills are zero coupon securities and pay no interest.

- Treasury bills are available for a minimum amount of 25,000 rupees and in multiples of Rs. 25,000.

Let us understand the concept with an example –

Let us assume – The government need money for short -term period, for project A. The government will direct RBI to auctioned instruments to raise short-term money.

- RBI auctioned Treasury bill of Rs. 50,000 which have maturity period of 91days.

- Sahil purchased this Treasury Bill which is auctioned by RBI.

- The face value of the Treasury Bill is Rs. 50,000 and RBI issued at a price of Rs. 45,000.

- It means RBI sell Treasury bill at discount or price less than face value. So, here Sahil gets a discount of Rs. 5,000.

- After maturity period i.e. 91 days when Sahil will sell the Treasury Bill, he will the receive the Rs. 50,000 i.e. is the actual face value of the Treasury Bill.

Definition:

- Treasury Bills is a short-term money instrument which is issued by the government of India and auctioned by RBI.

- It has maturity period less than a year.

Note:

- Treasury bills are issued when the government need money for a shorter period while bonds are issued when it need debt for more than say five years.

Commercial paper

Commercial paper is an unsecured, short-term debt instrument which is issued by a company (Non-Banking Finance Companies (NBFCs) and All India Financial Institutions (AIFIs).

Tenure

- The original tenor of a CP shall be between seven days to one year.

Denomination

- A CP shall be issued in the minimum denomination of ₹ 5 lakh and multiples thereof.

Let us understand the concept with an example

Let us assume – Big Basket is an online grocery store which aims to offer more services to their customer. Thus, a company need some capital (money) for this new service.

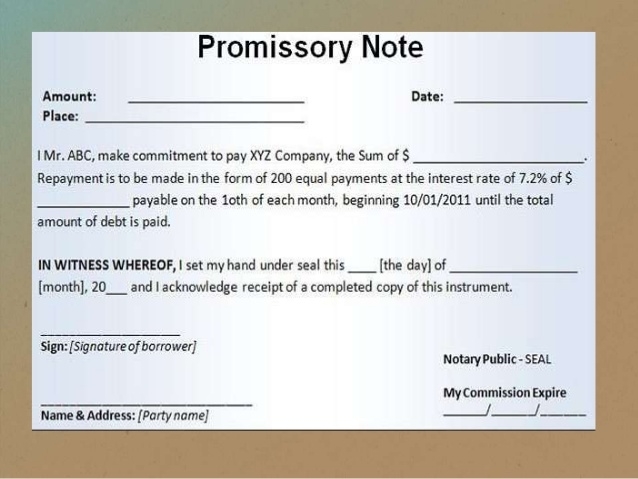

- To raise the capital, Big Basket will issue money raising instrument in form of a Promissory note which will be a written document by the company i.e. it will pay the amount back to the client at a certain date and with a certain rate of interest rate.

- Rahul is a client and purchased that money raising instrument issued by the Big Basket company.

- The total amount of the instrument is Rs. 10 lakhs. The maturity period is 270 days and the interest rate is 6%.

- The total amount Rahul will receive after 270 days is 11 lakh (assume). An amount received by Sahil will be more than principal or issued price.

Definition – Money raising instrument in the form of a promissory note issued by companies to meet specific short-term needs, with minimum issuing amount of 5 Lakh is known as Commercial Paper.

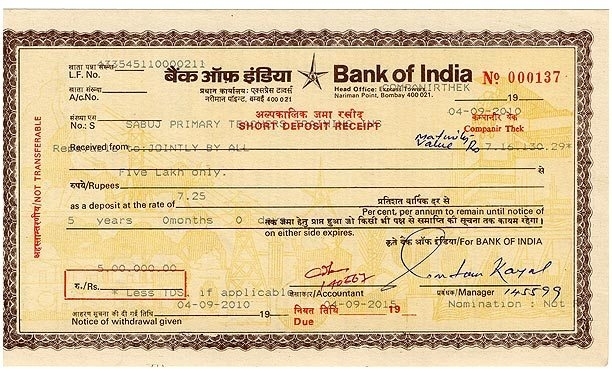

Certificate of Deposits

Certificate of Deposit (CD) is a negotiable money market instrument which is issued by a bank.

CDs can be issued by

(i) scheduled commercial banks {excluding Regional Rural Banks and Local Area Banks}; and

(ii) select All-India Financial Institutions (FIs) that have been permitted by RBI.

Maturity period

- The maturity period of CDs issued by banks should not be less than 7 days and not more than one year, from the date of issue.

Denomination

- A CD shall be issued in the minimum denomination of ₹1 lakh and multiples thereof.

Definition – A debt market (money raising) instrument issued in form of Promissory note issued by banks to meet specific needs with minimum issued amount is Rs 1 lakh is known as Certificate of Deposit.

———————————————-

Attempt the Quiz based on the article

Thanks

Team Gradeup