UGC NET Study Notes on Dividend Theories

By BYJU'S Exam Prep

Updated on: September 13th, 2023

When an organisation makes a profit, it distributes a part of it to all the shareholders, which is known as Dividend and reinvests the remaining to expand its operations (retaining of earnings).

- In other words, we can say that Dividend is an amount which is distributed per share to the shareholders. The amount of the Dividend is proportional to the shareholding pattern of the shareholders. If a person has one thousand shares of a company and the company has announced a dividend of one rupee per share, then that person will be paid one thousand rupees as a dividend amount. A company generally deposits the Dividend into the bank account of shareholders.

- Dividends provide a considerable income at regular intervals of time to the shareholders. It is like a recognition of shareholders by the company.

Theories of Dividend

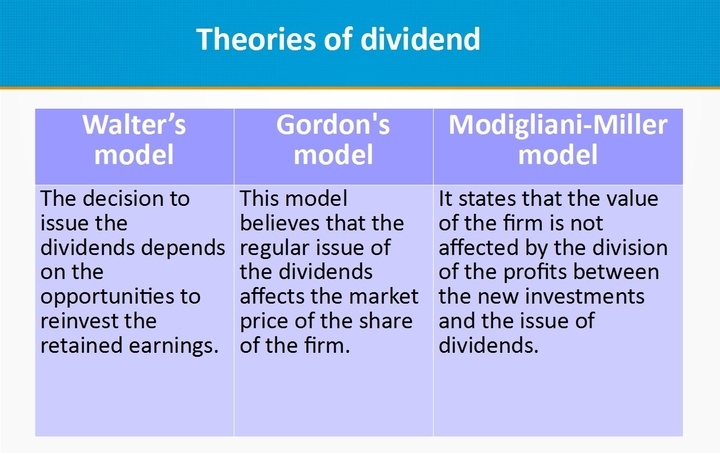

There are three theories that explain the relationship between the value of the firms and the Dividend issued by the firms. They are as follows:

- Walter’s model

- Gordon’s Model

- Modigliani-Miller model

- If a theory believes that the dividend policy of the firm will have an impact on the market price of the share, then it is known as relevance theory of Dividend.

- If a theory believes that the dividend policy of the firm will not have any impact on the market price of the share, then it is known as Irrelevance theory of Dividend.

- Of the three theories, Walter and Gordon’s models fall under the relevance theory of Dividend, whereas Modigliani-Miller model supports the Irrelevance theory of Dividend.

A. Walter’s Model: The decision to issue the dividends depends on the opportunities to reinvest the retained earnings.

- If the firm finds a good opportunity to invest the profits, it may not issue the dividends to its shareholders. In this case, the firm calculates the rate of return “r” of the investments.

- If the shareholders believe that the decisions of the firm are positive, then they may reinvest the dividends to buy more shares of the firm. This will result in an increase in the demand for the shares of the firm. This is known as opportunity cost or cost of capital “k”.

- If r is greater than k, then the firm should proceed with the investments, and it should not issue any dividends.

- If r is equal to k, then the firm has the choice to choose from the two options.

- If r is less than k, then the firm should proceed with the issue of dividends to its shareholders.

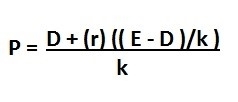

- The formula of the model is given below.

Where,

- P = Market price of the share

- D = Dividend per share

- r = Rate of return on the investments of the firm

- k = cost of capital

- E = Earnings per share

Assumptions of Walter’s model are as follows:

- The firm has no external financing sources. The retained earnings are the only sources for further expansion.

- The risks of the business remain the same even if the firm makes a new business decision. The rate of return “r” and the cost of capital “k” remains constant.

- The firm continues to proceed, and there is no closing down of the business.

Criticism of Walter’s model:

- The firm will not have a single source of financing.

- The risks of the business will not be the same. If the new investments are made, the risk factor may increase after a period of time due to the entry of new firms.

- The firm may not continue to proceed because of the heavy losses.

B. Gordon's model: This model believes that the regular issue of the dividends affects the market price of the share of the firm.

- The shareholders believe that the current dividends provide a considerable income to them rather than depending on the future gains.

- The shareholders assume that the future gains from the shares are not guaranteed.

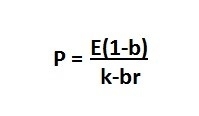

- The formula is given below.

Where,

- P = Market price of the share

- E = Earnings per share

- b = Retention ratio (1 – payout ratio)

- r = Rate of return on the investments of the firm

- k = cost of capital

- br = Growth rate of the firm (g)

Assumptions of Gordon's Model are as follows:

- The firm has no external financing sources. The retained earnings are the only sources for further expansion.

- The risks of the business remain the same even if the firm makes a new business decision. The rate of return “r” and the cost of capital “k” remains constant.

- The firm continues to proceed, and there is no closing down of the business.

- The growth rate of the firm “g” is the product of retention ratio “b” and the rate of return “r” (g=br).

- The cost of capital k is not only constant but also greater than the growth rate.

Criticism of Gordon's Model:

- The firm will not have a single source of financing.

- The cost of capital may not be constant.

C. Modigliani-Miller model: It states that the value of the firm is not affected by the division of the profits between the new investments and the issue of dividends. The value of the firm is determined by the financial management of the firm.

- This model is also known as capital structure irrelevancy theory or operating income theory.

- The shareholders have no preferences between the payment of dividends and the retainment of the profits.

- The firm may issue new shares to raise the capital or search for other sources for further expansion.

Assumptions of Modigliani-Miller model are as follows:

- The existence of the rational behaviour of the shareholders.

- The shareholders will have access to free information.

- There will be no time lag and transaction costs.

- The securities can be split, and there will not be any taxes.

- The profits can be estimated.

Criticism of Modigliani-Miller Model:

- The shareholders may not agree with the decisions of the firm regarding the expansion of the firm or the issue of dividends.

- The profits can not be estimated every time.

- There will be some amount of taxes and transaction costs.

Summary

- A dividend is an amount that is distributed per share to the shareholders.

- Walter’s model states that the decision to issue dividends depends on the opportunities to reinvest the retained earnings.

- According to Walter’s model, if the firm finds a good opportunity to invest the profits, it may not issue the dividends to its shareholders. If the shareholders have trust in the decisions of the firm, then they may reinvest the dividends to buy more shares.

- Gordon's model believes that the regular issue of the dividends affects the market price of the share of the firm.

- The shareholders assume that the future gains from the shares are not guaranteed. They believe that the current dividends provide a considerable income to them.

- Modigliani-Miller model states that the value of the firm is not affected by the division of the profits between the new investments and the issue of dividends.

Thanks