List of Merger of Public Sector Banks in India 2022

By BYJU'S Exam Prep

Updated on: September 25th, 2023

Government of India (GoI) has consolidated 10 Public Sector Banks into 4 banks. The announcement of this mega-merger was made by Union Finance Minister Nirmala Sitharaman in 2019. However, RBI notified it in the late March through its circular to merge banks in the new financial year (1st April 2020). As per the finance minister, the merger would help to manage the capital more efficiently. The amalgamation of the PSBs is based on bad loans intensity and regional factors.

After this mergers, the country is having a total of 12 public sector banks, including State Bank of India (SBI) and Bank of Baroda (BoB). This will result in seven large public sector banks and five smaller ones. There were as many as 27 PSBs in 2017.

Table of content

What’s also noteworthy is the fact that the government had infused capital worth more than Rs 55,000 crores into public sector banks (PSBs). The government move to reduce the number of Public Sector Banks from the existing 21 to 12 is for creating 3-4 global sized banks.

Also, customers including depositors of merging banks will be treated as customers of the banks in which these banks have been merged.

Merger List of PSU Banks in India

| Sl. No | Acquirer Banks | Banks to be Merged |

|---|---|---|

| 1. | Punjab National Bank(PNB) | Oriental Bank of Commerce and United Bank of India |

| 2. | Indian Bank | Allahabad Bank |

| 3. | Canara Bank | Syndicate Bank |

| 4. | Union Bank of India | Andhra Bank and Corporation Bank |

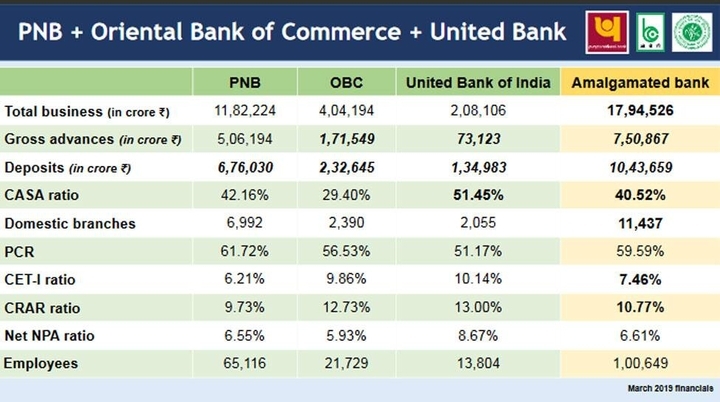

1. Punjab National Bank

Punjab National Bank (PNB) will take over Oriental Bank of Commerce and United Bank of India as an anchor bank. It will become the country’s second-largest bank, with business size of Rs 17.94 lakh crore, after SBI which has the business of over Rs 52 lakh crore. Punjab National Bank (PNB) has unveiled a new logo as it merges with United Bank of India and OBC with it, with effect from April 1. The new logo will bear distinct signages of all the three public sector lenders.

MD & CEO of Punjab National Bank: Atul Kumar Goel

2. Canara Bank:

Canara Bank will take over Syndicate Bank, and it will be the fourth-largest public sector bank of the country. After the merger, the combined business will be Rs 15.20 lakh crore. Canara Bank will get about Rs 6,500 crore capital from the government.

MD & CEO of Canara Bank: L V Prabhakar

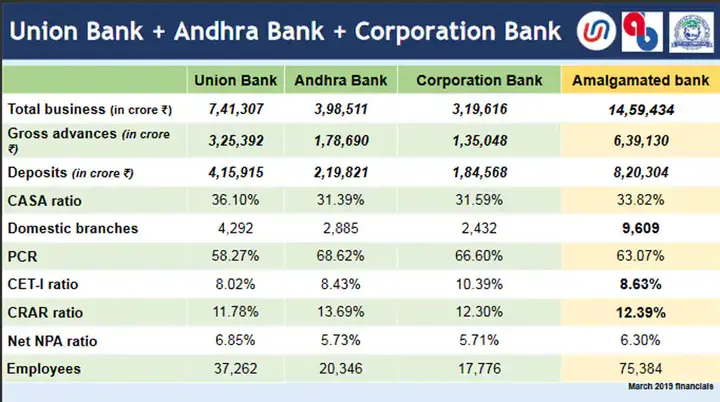

3. Union Bank of India:

Union Bank of India will see itself taking over Andhra Bank and Corporation Bank. Post-merger it will become 5th largest PSB. The combined business base of the merged bank will be Rs 14.59 lakh crore. Union Bank has a high Net NPA ratio of 6.85%. The government will provide Rs 11,700 crore to Union Bank for the merger process.

MD & CEO of Union Bank of India: A Manimekhalai

4. Indian Bank:

Indian Bank will merge with Allahabad Bank, and the combined business will be Rs 8.07 lakh crore. Post-merger it will become 7th largest PSB. Indian Bank had a net NPA ratio of 3.75%. Bank will get Rs 2,500 crore worth capital from the government to complete the merger.

MD & CEO of Indian Bank: Shanti Lal Jain

Post the mega-merger, the six PSBs that will remain independent are as follows:

1. Indian Overseas Bank,

2. UCO Bank,

3. Bank of Maharashtra,

4. Punjab and Sind Bank

5. Bank of India, and

6. Central Bank of India.

NOTE: In 2019, the government had merged Dena Bank and Vijaya Bank with Bank of Baroda, creating the third-largest bank by loans in the country.

Impact of PSU Bank Mergers

The merger of PSU banks has its share of merits and demerits. The addition of staff and network is the effect that can be easily gauged from the impending merger move. What else can emerge due to the merger? Don’t know? Let us have a look below.

Merits of Merger-

- A large capital base would help the acquirer banks to offer a large loan amount

- Service delivery can get improved

- Recapitalization need from the government to reduce

- Customers will have a wide array of products like mutual funds and insurance to choose from, in addition to the traditional loans and deposits

- Technological up-gradation on the cards and various other products

- With fewer banks, it is possible for the ministry to better focus on the banks on its watch.

Demerits of Merger-

- It would be tough to manage issues pertaining to human resource

- Few large inter-linked banks can expose the broader economy to enhanced financial risks

- The local identity of small banks won’t be that prominent.

So, this was all from our side regarding the merger of Public sector banks. If you have any further query or feedback, do let us know in the comment section. If you liked this post do not forget to upvote it so that we come to know how you liked this article and we can put similar articles in the future.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>